Santa Clara, Calif., – September 6, 2023 – Couchbase, Inc. (NASDAQ: BASE), the cloud database platform company, today announced financial results for its second quarter ended July 31, 2023. “We delivered revenue and profitability that exceeded the high end of our guidance range, highlighted by 24% ARR growth, strong retention, and increasing momentum with Capella,” said Matt Cain, Chair, President and CEO of Couchbase. “As we look to the second half of the fiscal year, we are poised to continue to make strong progress on our strategic initiatives, including investing in our cloud database platform for what we believe will be a very exciting future underpinned by AI-powered applications.”

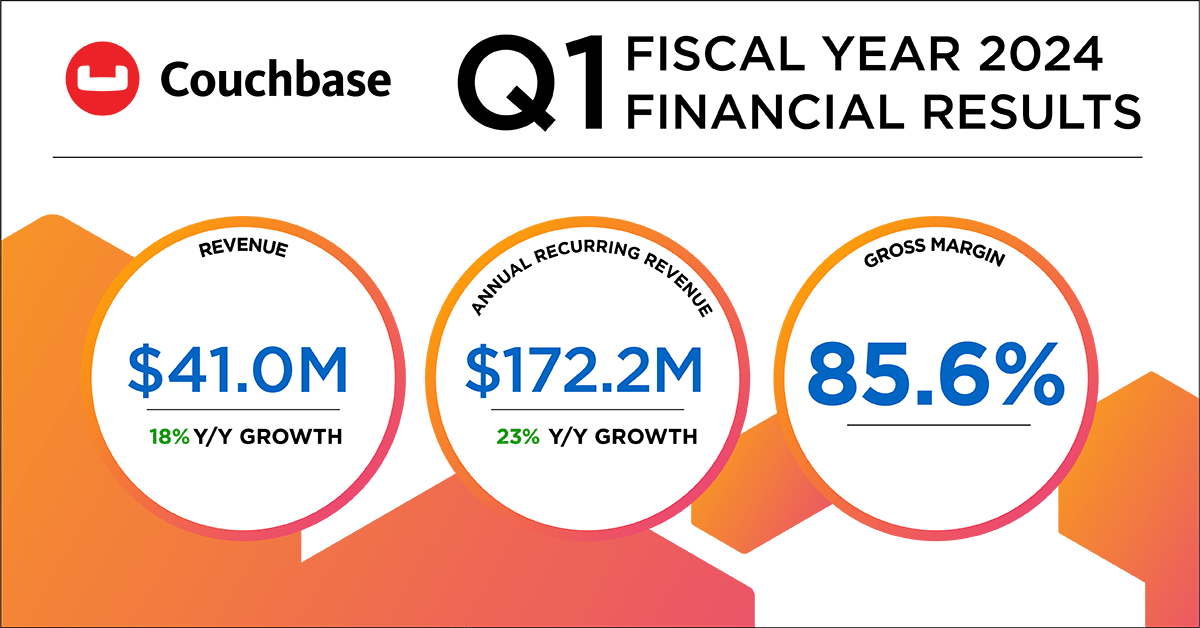

Second Quarter Fiscal 2024 Financial Highlights

- Revenue: Total revenue for the quarter was $43.1 million, an increase of 8% year-over-year. Subscription revenue for the quarter was $41.0 million, an increase of 11% year-over-year.

- Annual recurring revenue (ARR): Total ARR as of July 31, 2023 was $180.7 million, an increase of 24% year-over-year, or 23% on a constant currency basis. See the section titled “Key Business Metrics” below for details.

- Gross margin: Gross margin for the quarter was 86.3%, compared to 88.0% for the second quarter of fiscal 2023. Non-GAAP gross margin for the quarter was 87.2%, compared to 88.7% for the second quarter of fiscal 2023. See the section titled “Use of Non-GAAP Financial Measures” and the tables titled “Reconciliation of GAAP to Non-GAAP Results” below for details.

- Loss from operations: Loss from operations for the quarter was $21.9 million, compared to $15.2 million for the second quarter of fiscal 2023. Non-GAAP operating loss for the quarter was $9.2 million, compared to $8.4 million for the second quarter of fiscal 2023.

- Cash flow: Cash flow used in operating activities for the quarter was $0.5 million, compared to $7.7 million in the second quarter of fiscal 2023. Capital expenditures were $1.1 million during the quarter, leading to negative free cash flow of $1.6 million, compared to negative free cash flow of $9.3 million in the second quarter of fiscal 2023.

- Remaining performance obligations (RPO): RPO as of July 31, 2023 was $170.6 million, an increase of 2% year-over-year.

Recent Business Highlights

- Announced that Couchbase is introducing generative AI into its Database-as-a-Service Couchbase Capella™ designed to significantly enhance developer productivity and accelerate time to market for modern applications. This new capability, called Capella iQ, is designed to enable developers to write SQL++ and application-level code more quickly by delivering recommended sample code.

- Announced the Couchbase AI Accelerate Partner Program designed to make it easier for customers to build AI-powered applications with Couchbase Capella and support integrations with the broader AI and data ecosystem. The goal of the program is to provide organizations with resources to quickly integrate their platforms and tools with Couchbase Capella, thereby reducing friction for customers who are building and deploying models for AI-driven applications.

- Granted two additional U.S. patents, demonstrating the company’s continued high velocity of product innovation and differentiation. One is Couchbase’s fourth patent, which was granted for executing transactions on distributed databases. The other is Couchbase’s fifth patent, which was for cost-based query optimization for array fields in database systems.

- Announced additional enhancements to Couchbase Capella that further improve the developer experience, increase efficiency and make it easier to operate a cloud database platform. This includes new integrations with popular developer tools Vercel and the IntelliJ family of integrated development environments (IDEs), dynamic disk input/output operations per second (IOPS), on/off provisioned database capability to better align with developer usage patterns and the achievement of independent validation for Payment Card Industry Data Security Standard (PCI DSS) and Cloud Security Alliance Security Trust Assurance and Risk (CSA STAR) compliance.

Financial Outlook

For the third quarter and full year of fiscal 2024, Couchbase expects:

| |

Q3 FY2024 Outlook |

FY2024 Outlook |

| Total Revenue |

$42.7-43.3 million |

$171.7-174.7 million |

| Total ARR |

$185.0-188.0 million |

$195.5-199.5 million |

| Non-GAAP Operating Loss |

$9.9-9.1 million |

$42.5-38.5 million |

The guidance provided above is based on several assumptions that are subject to change and many of which are outside our control. If actual results vary from these assumptions, our expectations may change. There can be no assurance that we will achieve these results.

Couchbase is not able, at this time, to provide GAAP targets for operating loss for the third quarter or full year of fiscal 2024 because of the difficulty of estimating certain items excluded from non-GAAP operating loss that cannot be reasonably predicted, such as charges related to stock-based compensation expense. The effect of these excluded items may be significant.

Conference Call Information

Couchbase will host a live webcast at 2:00 p.m. Pacific Time (or 5:00 p.m. Eastern Time) on Wednesday, September 6, 2023, to discuss its financial results and business highlights. The conference call can be accessed by dialing 877-407-8029 from the United States, or +1 201-689-8029 from international locations. The live webcast and a webcast replay can be accessed from the investor relations page of Couchbase’s website at investors.couchbase.com.

Use of Non-GAAP Financial Measures

In addition to our financial information presented in accordance with GAAP, we believe certain non-GAAP financial measures are useful to investors in evaluating our operating performance. We use certain non-GAAP financial measures, collectively, to evaluate our ongoing operations and for internal planning and forecasting purposes. We believe that non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, may be helpful to investors because they provide consistency and comparability with past financial performance and meaningful supplemental information regarding our performance by excluding certain items that may not be indicative of our business, results of operations or outlook. Non-GAAP financial measures are presented for supplemental informational purposes only, have limitations as analytical tools and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP, and may be different from similarly-titled non-GAAP financial measures used by other companies. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures (provided in the financial statement tables included in this press release), and not to rely on any single financial measure to evaluate our business.

Non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating loss, non-GAAP operating margin, non-GAAP net loss and non-GAAP net loss per share:

We define these non-GAAP financial measures as their respective GAAP measures, excluding expenses related to stock-based compensation expense, employer payroll taxes on employee stock transactions and restructuring charges. We use these non-GAAP financial measures in conjunction with GAAP measures to assess our performance, including in the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies and to communicate with our board of directors concerning our financial performance.

Free cash flow:

We define free cash flow as cash used in operating activities less additions to property and equipment, which includes capitalized internal-use software costs. We believe free cash flow is a useful indicator of liquidity that provides our management, board of directors and investors with information about our future ability to generate or use cash to enhance the strength of our balance sheet and further invest in our business and pursue potential strategic initiatives. Please see the reconciliation tables at the end of this press release for the reconciliation of GAAP and non-GAAP results.

Key Business Metrics

We review a number of operating and financial metrics, including ARR, to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans and make strategic decisions. We define ARR as of a given date as the annualized recurring revenue that we would contractually receive from our customers in the month ending 12 months following such date. Based on historical experience with customers, we assume all contracts will be automatically renewed at the same levels unless we receive notification of non-renewal and are no longer in negotiations prior to the measurement date. ARR also includes revenue from consumption-based cloud credits of Couchbase Capella products. ARR for Couchbase Capella products in a customer’s initial year is calculated as described above; after a customer’s initial year it is calculated by annualizing the prior 90 days of actual consumption, assuming no increases or reductions in usage. ARR excludes revenue derived from the use of cloud products only based on on-demand arrangements and services revenue. ARR should be viewed independently of revenue, and does not represent our revenue under GAAP on an annualized basis, as it is an operating metric that can be impacted by contract start and end dates and renewal dates. ARR is not intended to be a replacement for forecasts of revenue. Although we seek to increase ARR as part of our strategy of targeting large enterprise customers, this metric may fluctuate from period to period based on our ability to acquire new customers and expand within our existing customers. We believe that our ARR is an important indicator of the growth and performance of our business. We updated our definition of ARR in the third quarter of fiscal 2023 to clarify that the 90-day actual consumption methodology is only used after a customer’s initial year. The reason for this change is to better reflect the ARR for Couchbase Capella products following the launch of Couchbase Capella in fiscal 2022. ARR for prior periods have not been adjusted to reflect this change as it is not material to any period previously presented. We also attempt to represent the changes in the underlying business operations by eliminating fluctuations caused by changes in foreign currency exchange rates within the current period. We calculate constant currency growth rates by applying the applicable prior period exchange rates to current period results.

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include, but are not limited to, quotations of management, the section titled “Financial Outlook” above and statements about Couchbase’s market position, strategies and potential market opportunities. Forward-looking statements generally relate to future events or our future financial or operating performance. Forward-looking statements include all statements that are not historical facts and, in some cases, can be identified by terms such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “continue,” “could,” “potential,” “remain,” “may,” “might,” “will,” “would” or similar expressions and the negatives of those terms. However, not all forward-looking statements contain these identifying words. Forward-looking statements involve known and unknown risks, uncertainties and other factors, including factors beyond our control, which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks include, but are not limited to: our history of net losses and ability to achieve or maintain profitability in the future; our ability to continue to grow on pace with historical rates; our ability to manage our growth effectively; intense competition and our ability to compete effectively; cost-effectively acquiring new customers or obtaining renewals, upgrades or expansions from our existing customers; the market for our products and services being relatively new and evolving, and our future success depending on the growth and expansion of this market; our ability to innovate in response to changing customer needs, new technologies or other market requirements, including new capabilities, programs and partnerships and their impact on our customers and our business; our limited operating history, which makes it difficult to predict our future results of operations; the significant fluctuation of our future results of operations and ability to meet the expectations of analysts or investors; our significant reliance on revenue from subscriptions, which may decline and, the recognition of a significant portion of revenue from subscriptions over the term of the relevant subscription period, which means downturns or upturns in sales are not immediately reflected in full in our results of operations; and the impact of geopolitical and macroeconomic factors. Further information on risks that could cause actual results to differ materially from forecasted results are included in our filings with the Securities and Exchange Commission that we may file from time to time, including those more fully described in our Annual Report on Form 10-K for the fiscal year ended January 31, 2023. Additional information will be made available in our Quarterly Report on Form 10-Q for the quarter ended July 31, 2023 that will be filed with the Securities and Exchange Commission, which should be read in conjunction with this press release and the financial results included herein. Any forward-looking statements contained in this press release are based on assumptions that we believe to be reasonable as of this date. Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons if actual results differ materially from those anticipated in the forward-looking statements.

Couchbase, Inc.

Condensed Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

|

Three Months Ended July 31, |

Six Months Ended July 31, |

|

2023 |

2022 |

2023 |

2022 |

| Revenue: |

|

|

|

|

| License |

$4,798 |

$6,382 |

$9,741 |

$11,389 |

| Support and other |

36,156 |

30,677 |

69,755 |

57,651 |

| Total subscription revenue |

40,954 |

37,059 |

79,496 |

69,040 |

| Services |

2,185 |

2,732 |

4,639 |

5,604 |

| Total revenue |

43,139 |

39,791 |

84,135 |

74,644 |

| Cost of revenue: |

|

|

|

|

| Subscription(1) |

3,845 |

2,521 |

7,518 |

4,917 |

| Services(1) |

2,064 |

2,260 |

4,313 |

4,515 |

| Total cost of revenue |

5,909 |

4,781 |

11,831 |

9,432 |

| Gross profit |

37,230 |

35,010 |

72,304 |

65,212 |

| Operating expenses: |

|

|

|

|

| Research and development(1) |

16,292 |

14,341 |

31,675 |

28,762 |

| Sales and marketing(1) |

32,348 |

27,473 |

64,901 |

54,316 |

| General and administrative(1) |

10,459 |

8,429 |

20,084 |

16,355 |

| Restructuring(1) |

— |

— |

46 |

— |

| Total operating expenses |

59,099 |

50,243 |

116,706 |

99,433 |

| Loss from operations |

(21,869) |

(15,233) |

(44,402) |

(34,221) |

| Interest expense |

(18) |

(25) |

(43) |

(50) |

| Other income (expense), net |

1,255 |

261 |

2,688 |

(295) |

| Loss before income taxes |

(20,632) |

(14,997) |

(41,757) |

(34,566) |

| Provision for income taxes |

19 |

372 |

769 |

637 |

| Net loss |

$(20,651) |

$(15,369) |

$(42,526) |

$(35,203) |

| Net loss per share, basic and diluted |

$(0.44) |

$(0.34) |

$(0.92) |

$(0.79) |

| Weighted-average shares used in computing net loss per share, basic and diluted |

46,714 |

44,648 |

46,285 |

44,459 |

_______________________________ (1) Includes stock-based compensation expense as follows:

|

Three Months Ended July 31, |

Six Months Ended July 31, |

|

2023 |

2022 |

2023 |

2022 |

| Cost of revenue—subscription |

$236 |

$141 |

$429 |

$263 |

| Cost of revenue—services |

149 |

117 |

294 |

211 |

| Research and development |

3,614 |

2,087 |

6,382 |

3,986 |

| Sales and marketing |

4,032 |

2,463 |

7,273 |

4,450 |

| General and administrative |

4,086 |

1,919 |

7,014 |

3,267 |

| Restructuring |

— |

— |

1 |

— |

| Total stock-based compensation expense |

$12,117 |

$6,727 |

$21,393 |

$12,177 |

Couchbase, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

|

As of July 31, 2023 |

As of January 31, 2023 |

| Assets |

|

|

| Current assets |

|

|

| Cash and cash equivalents |

$ 41,437 |

$ 40,446 |

| Short-term investments |

124,361 |

127,856 |

| Accounts receivable, net |

32,453 |

39,847 |

| Deferred commissions |

12,787 |

13,096 |

| Prepaid expenses and other current assets |

8,034 |

8,234 |

| Total current assets |

219,072 |

229,479 |

| Property and equipment, net |

8,581 |

7,430 |

| Operating lease right-of-use assets |

5,620 |

6,940 |

| Deferred commissions, noncurrent |

7,736 |

7,524 |

| Other assets |

2,645 |

1,666 |

| Total assets |

$ 243,654 |

$ 253,039 |

| Liabilities and Stockholders’ Equity |

|

|

| Current liabilities |

|

|

| Accounts payable |

$ 3,156 |

$ 1,407 |

| Accrued compensation and benefits |

10,887 |

12,641 |

| Other accrued expenses |

4,874 |

6,076 |

| Operating lease liabilities |

2,984 |

3,117 |

| Deferred revenue |

79,721 |

71,716 |

| Total current liabilities |

101,622 |

94,957 |

| Operating lease liabilities, noncurrent |

3,271 |

4,543 |

| Deferred revenue, noncurrent |

3,219 |

3,275 |

| Total liabilities |

108,112 |

102,775 |

| Stockholders’ equity |

|

|

| Preferred stock |

— |

— |

| Common stock |

— |

— |

| Additional paid-in capital |

588,845 |

561,547 |

| Accumulated other comprehensive loss |

(301) |

(807) |

| Accumulated deficit |

(453,002) |

(410,476) |

| Total stockholders’ equity |

135,542 |

150,264 |

| Total liabilities and stockholders’ equity |

$ 243,654 |

$ 253,039 |

Couchbase, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

(unaudited)

|

Three Months Ended July 31, |

Six Months Ended January 31, |

|

2023 |

2022 |

2023 |

2022 |

| Cash flows from operating activities |

|

|

|

|

| Net loss |

$(20,651) |

$(15,369) |

$(42,526) |

$(35,203) |

| Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

| Depreciation and amortization |

745 |

727 |

1,635 |

1,466 |

| Stock-based compensation, net of amounts capitalized |

12,117 |

6,727 |

21,393 |

12,177 |

| Amortization of deferred commissions |

4,702 |

4,401 |

9,242 |

8,410 |

| Non-cash lease expense |

776 |

752 |

1,548 |

1,400 |

| Foreign currency transaction losses |

249 |

62 |

165 |

1,036 |

| Other |

(1,030) |

103 |

(1,776) |

301 |

| Changes in operating assets and liabilities |

|

|

|

|

| Accounts receivable |

9,811 |

(4,452) |

7,537 |

7,329 |

| Deferred commissions |

(4,322) |

(3,908) |

(9,146) |

(7,706) |

| Prepaid expenses and other assets |

(1,523) |

(1,526) |

(118) |

(1,214) |

| Accounts payable |

(3,713) |

2,812 |

1,745 |

3,543 |

| Accrued compensation and benefits |

2,306 |

2,504 |

(1,754) |

(5,608) |

| Accrued expenses and other liabilities |

(615) |

1,106 |

(1,871) |

1,035 |

| Operating lease liabilities |

(897) |

(445) |

(1,723) |

(1,111) |

| Deferred revenue |

1,526 |

(1,149) |

7,949 |

(2,117) |

| Net cash used in operating activities |

(519) |

(7,655) |

(7,700) |

(16,262) |

| Cash flows from investing activities |

|

|

|

|

| Purchases of short-term investments |

(56,494) |

(15,838) |

(64,315) |

(69,468) |

| Maturities of short-term investments |

50,697 |

23,202 |

70,120 |

32,802 |

| Additions to property and equipment |

(1,071) |

(1,677) |

(2,359) |

(2,476) |

| Net cash provided by (used in) investing activities |

(6,868) |

5,687 |

3,446 |

(39,142) |

| Cash flows from financing activities |

|

|

|

|

| Proceeds from exercise of stock options |

2,733 |

753 |

4,650 |

3,367 |

| Proceeds from issuance of common stock under ESPP |

— |

— |

847 |

3,525 |

| Net cash provided by financing activities |

2,733 |

753 |

5,497 |

6,892 |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

(149) |

(119) |

(252) |

(838) |

| Net increase (decrease) in cash, cash equivalents and restricted cash |

(4,803) |

(1,334) |

991 |

(49,350) |

| Cash, cash equivalents, and restricted cash at beginning of period |

46,783 |

48,215 |

40,989 |

96,231 |

| Cash, cash equivalents, and restricted cash at end of period |

$41,980 |

$46,881 |

$41,980 |

$46,881 |

| Reconciliation of cash, cash equivalents, and restricted cash within the consolidated balance sheets to the amounts shown above: |

|

|

|

|

| Cash and cash equivalents |

$41,437 |

$46,338 |

$41,437 |

$46,338 |

| Restricted cash included in other assets |

543 |

543 |

543 |

543 |

| Total cash, cash equivalents and restricted cash |

$41,980 |

$46,881 |

$41,980 |

$46,881 |

Couchbase, Inc.

Reconciliation of GAAP to Non-GAAP Results

(in thousands, except per share data)

(unaudited)

|

Three Months Ended July 31, |

Six Months Ended July 31, |

|

2023 |

2022 |

2023 |

2022 |

| Reconciliation of GAAP gross profit to non-GAAP gross profit: |

|

|

|

|

| Total revenue |

$43,139 |

$39,791 |

$84,135 |

$74,644 |

| Gross profit |

$37,230 |

$35,010 |

$72,304 |

$65,212 |

| Add: Stock-based compensation expense |

385 |

258 |

723 |

474 |

| Add: Employer taxes on employee stock transactions |

21 |

22 |

31 |

24 |

| Non-GAAP gross profit |

$37,636 |

$35,290 |

$73,058 |

$65,710 |

| Gross margin |

86.3% |

88.0% |

85.9% |

87.4% |

| Non-GAAP gross margin |

87.2% |

88.7% |

86.8% |

88.0% |

|

Three Months Ended July 31, |

Six Months Ended July 31, |

|

2023 |

2022 |

2023 |

2022 |

| Reconciliation of GAAP operating expenses to non-GAAP operating expenses: |

|

|

|

|

| GAAP research and development |

$16,292 |

$14,341 |

$31,675 |

$28,762 |

| Less: Stock-based compensation expense |

(3,614) |

(2,087) |

(6,382) |

(3,986) |

| Less: Employer taxes on employee stock transactions |

(123) |

(45) |

(231) |

(69) |

| Non-GAAP research and development |

$12,555 |

$12,209 |

$25,062 |

$24,707 |

|

|

|

|

|

| GAAP sales and marketing |

$32,348 |

$27,473 |

$64,901 |

$54,316 |

| Less: Stock-based compensation expense |

(4,032) |

(2,463) |

(7,273) |

(4,450) |

| Less: Employer taxes on employee stock transactions |

(330) |

(67) |

(450) |

(103) |

| Non-GAAP sales and marketing |

$27,986 |

$24,943 |

$57,178 |

$49,763 |

|

|

|

|

|

| GAAP general and administrative |

$10,459 |

$8,429 |

$20,084 |

$16,355 |

| Less: Stock-based compensation expense |

(4,086) |

(1,919) |

(7,014) |

(3,267) |

| Less: Employer taxes on employee stock transactions |

(59) |

(13) |

(88) |

(84) |

| Non-GAAP general and administrative |

$6,314 |

$6,497 |

$12,982 |

$13,004 |

|

|

|

|

|

| GAAP restructuring expense |

$— |

$— |

$46 |

$— |

| Less: Restructuring(2) |

— |

— |

(46) |

— |

| Non-GAAP restructuring |

$— |

$— |

$— |

$— |

|

Three Months Ended July 31, |

Six Months Ended July 31, |

|

2023 |

2022 |

2023 |

2022 |

| Reconciliation of GAAP operating loss to non-GAAP operating loss: |

|

|

|

|

| Total revenue |

$43,139 |

$39,791 |

$84,135 |

$74,644 |

| Loss from operations |

$(21,869) |

$(15,233) |

$(44,402) |

$(34,221) |

| Add: Stock-based compensation expense |

12,117 |

6,727 |

21,392 |

12,177 |

| Add: Employer taxes on employee stock transactions |

533 |

147 |

800 |

280 |

| Add: Restructuring(2) |

— |

— |

46 |

— |

| Non-GAAP operating loss |

$(9,219) |

$(8,359) |

$(22,164) |

$(21,764) |

| Operating margin |

(51)% |

(38)% |

(53)% |

(46)% |

| Non-GAAP operating margin |

(21)% |

(21)% |

(26)% |

(29)% |

|

Three Months Ended July 31, |

Six Months Ended July 31, |

|

2023 |

2022 |

2023 |

2022 |

| Reconciliation of GAAP net loss to non-GAAP net loss: |

|

|

|

|

| Net loss |

$(20,651) |

$(15,369) |

$(42,526) |

$(35,203) |

| Add: Stock-based compensation expense |

12,117 |

6,727 |

21,392 |

12,177 |

| Add: Employer taxes on employee stock transactions |

533 |

147 |

800 |

280 |

| Add: Restructuring(2) |

— |

— |

46 |

— |

| Non-GAAP net loss |

$(8,001) |

$(8,495) |

$(20,288) |

$(22,746) |

| GAAP net loss per share |

$(0.44) |

$(0.34) |

$(0.92) |

$(0.79) |

| Non-GAAP net loss per share |

$(0.17) |

$(0.19) |

$(0.44) |

$(0.51) |

| Weighted average shares outstanding, basic and diluted |

46,714 |

44,648 |

46,285 |

44,459 |

_______________________________

(2) For the six months ended July 31, 2023, an immaterial amount of stock-based compensation expense related to restructuring charges was included in the restructuring expense line.

The following table presents a reconciliation of free cash flow to net cash used in operating activities, the most directly comparable GAAP measure, for each of the periods indicated (in thousands, unaudited):

|

Three Months Ended July 31, |

Six Months Ended July 31, |

|

2023 |

2022 |

2023 |

2022 |

| Net cash used in operating activities |

$(519) |

$(7,655) |

$(7,700) |

$(16,262) |

| Less: Additions to property and equipment |

(1,071) |

(1,677) |

(2,359) |

(2,476) |

| Free cash flow |

$(1,590) |

$(9,332) |

$(10,059) |

$(18,738) |

| Net cash provided by (used in) investing activities |

$(6,868) |

$5,687 |

$3,446 |

$(39,142) |

| Net cash provided by financing activities |

$2,733 |

$753 |

$5,497 |

$6,892 |

Couchbase, Inc.

Key Business Metrics

(in millions)

(unaudited)

|

As of |

|

April 30, |

July 31, |

Oct. 31, |

Jan. 31, |

April 30, |

July 31, |

|

2022 |

2022 |

2022 |

2023 |

2023 |

2023 |

| Annual Recurring Revenue |

$139.7 |

$145.2 |

$151.7 |

$163.7 |

$172.2 |

$180.7 |