Following the incredible insights we received into cloud services from our 2022 CIO survey, in 2023 we wanted to dig deeper into the ways in which enterprises are using the cloud. Why are they switching? How essential is the cloud to helping enterprises balance IT spending? And is the cloud itself changing how organizations and their IT functions operate?

We surveyed 600 IT decision makers in the US, UK, France, Germany, Spain, Italy and Turkey in April-May 2023. Here’s what we found:

| Breakdown of respondents by region | ||||||||

| Total | US | Europe (Net) | UK | France | Germany | Spain | Italy | Turkey |

| 600 | 150 | 400 | 100 | 100 | 100 | 50 | 50 | 50 |

Why reach for the clouds?

The reasons enterprises move to the cloud are now well-understood. Factors such as guaranteed service availability; the ability to scale to meet demand; the agility to purchase new services as needed; and more control over costs are used by many service providers as selling points. There is also the simple fact that moving to the cloud can create access to applications and services that would be impossible, or at least very difficult, to implement in-house.

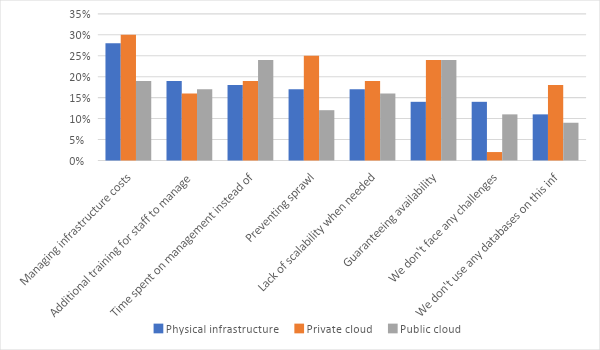

For instance, if we focus on databases, at least 80% of our respondents experience challenges with using databases that they own, whether the infrastructure that database is housed in is physical infrastructure, private cloud, or public cloud. Moving to a fully-fledged Database-as-a-Service offering could remove many of these challenges (fig. 1).

Fig.1 – Percentage of respondents who experience challenges with using databases

As well as avoiding the negatives of in-house management, respondents see the positives of switching to a cloud service model. From the flexibility to locate database infrastructure wherever is most cost-effective at any given moment, to better uptime SLAs, it’s understandable why 55% of enterprises believe further movement to the cloud is “inevitable” (fig. 2).

Fig. 2 – IT decision makers’ opinions on the cloud:

“We want the flexibility to locate our database infrastructure wherever is most cost-effective at any given moment” – 60%

“Further movement to the cloud is inevitable” – 55%

“We believe cloud service providers can offer better SLAs for uptime than our in-house team” – 54%

“We want our database infrastructure to be “invisible” – i.e. we don’t want to concern ourselves with managing it” – 50%

“The resources (i.e. skills, financial investment) we put into managing our database infrastructure would be better spent elsewhere” – 43%

“We don’t have the skills to fully manage our database infrastructure in-house” – 31%

Financial movement

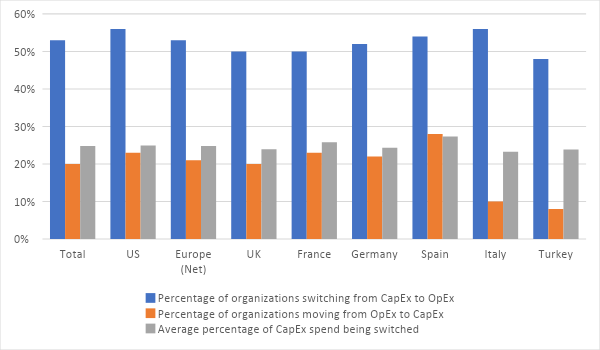

One great attraction of the cloud is the ability to switch spending from large, one-off capital expenditure (CapEx) to smaller, ongoing and largely more predictable operational expenditure (OpEx). In challenging economic times, this move to smaller payments that are easier to control is understandable. We can see that, while a minority of enterprises are moving OpEx spending to CapEx, most are moving their spending the other way: switching on average a quarter of their CapEx spending to OpEx (fig. 3).

Fig. 3 – Switches from CapEx to OpEx spending

The economic environment has certainly driven a revision of CapEx and OpEx spend. 58% of organizations are revising how they split their budget because of the current economic climate. In addition, the cost and availability of IT services are foremost in enterprises’ minds – whether using the cloud to balance IT spending, looking for ways to reduce spend and optimize costs, and paying closer attention to whether essential cloud service providers will remain in business (fig. 4). At a time when efficiency is a top business priority, a viable path to the cloud looks to be a must-have for enterprises.

Fig. 4 – IT decision makers’ opinions on economic concerns:

“We are revising how we split our budget between CapEx and OpEx because of the current economic climate” – 58%

“Using the cloud is essential if we are to balance IT spending” – 54%

“We are actively looking for ways to reduce and/or gain control of our cloud spend” – 44%

“We have increasingly adopted consumption-based cloud models to optimize costs” – 40%

“Our organization’s goal is to replace more of our internal IT functions with managed services” – 32%

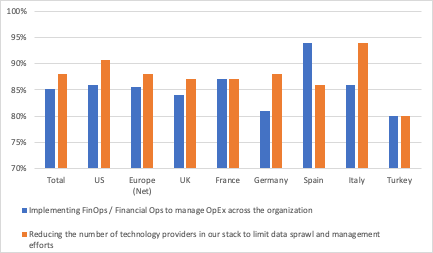

As part of the drive to reduce costs, enterprises are enacting or planning to enact new approaches. 85% have implemented or plan to implement FinOps to manage OpEx across the organization and control costs. And 88% are consolidating and optimizing their technology stack: reducing the number of technology providers to limit data sprawl and management efforts (fig. 5).

Fig. 5 – Actions taken to control costs and consolidate tech

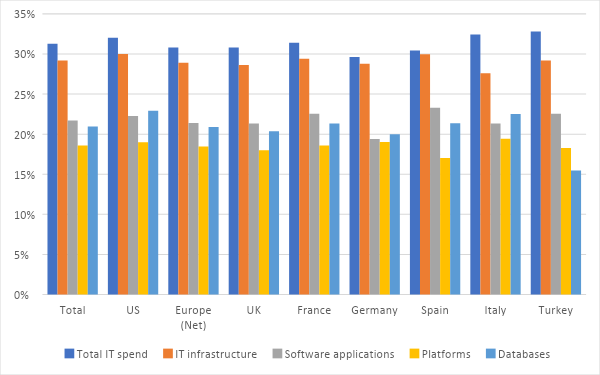

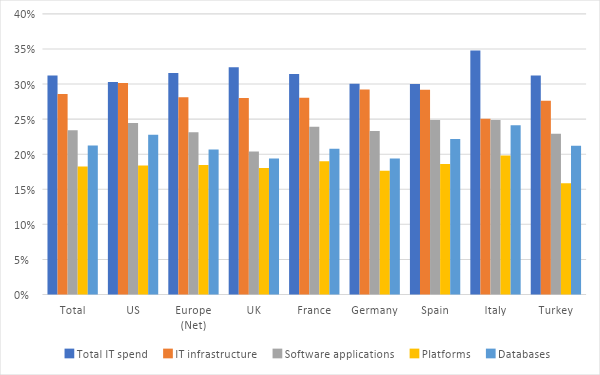

This need to control costs without sacrificing agility or scalability explains why enterprises continue their “inevitable” march towards the cloud. Indeed, by 2026, organizations predict that 31% of all their IT spending will be on the public cloud (fig. 6). So far, they are making moderate progress towards this goal – saying they are 31% of the way to meeting their ambitions (fig. 7).

Fig. 6 – Predicted percentage of IT spend in the public cloud by 2026

Fig. 7 – Progress towards reaching predicted spend

Bumps in the road?

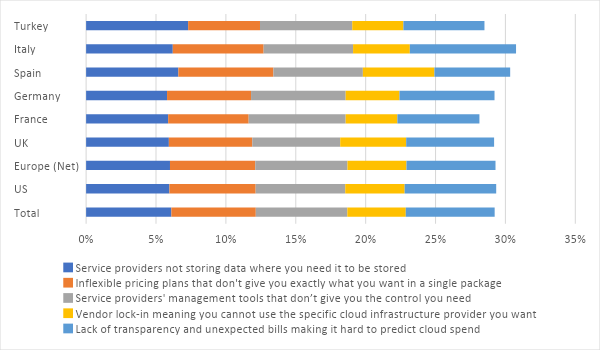

Despite the clear movement towards cloud, organizations are still facing challenges. For instance, compliance demands may mean that the organization needs to store data in a specific region, or with specific security controls. If a cloud provider cannot guarantee this, the organization needs to spend extra time and resources working around the issue to minimize risk. Similarly, vendor insistence that customers only use certain management tools, or only host infrastructure on certain providers, can limit options and increase costs as businesses adapt. Coupled with this are services that make it difficult to control costs, as the pricing options don’t allow for the exact level of service the business requires, or that do not offer the scalability enterprises need and expect (fig. 8).

Fig. 8 – Cloud challenges encountered by enterprises

“We have had to work around our cloud service providers’ offerings to ensure our data is stored where we need it – e.g. for reasons of compliance” – 55%

“Our ability to use cloud services is limited by our service providers’ insistence that we only use specific tools” – 44%

“We have chosen cloud services where we were “locked in” to using a single cloud infrastructure provider, limiting our options” – 39%

“We have found it challenging to accurately predict and control our cloud costs” – 39%

“We have had to over-spend on cloud services because the pricing options on offer did not suit our exact needs” – 38%

“We have invested in database infrastructure in the cloud, but have not been able to manage it in the exact way we want to” – 38%

“We have chosen cloud services that do not give us the necessary ability to scale the business to meet demand” – 32%

“We have had to restrict our digital transformation ambitions because of challenges we have faced with cloud services” – 32%

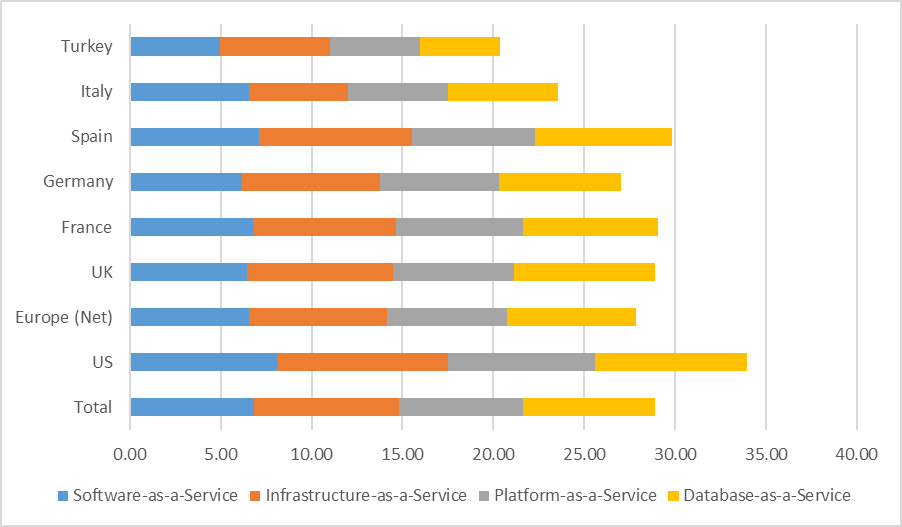

These challenges are having a direct impact on organizations’ cloud spend. At present, enterprises spend at least $28.91 million a year on cloud services – including Software-as-a-Service, Infrastructure-as-a-Service, Platform-as-a-Service and Database-as-a-Service (fig. 9).

Fig. 9 – Average cloud spend ($USD millions)

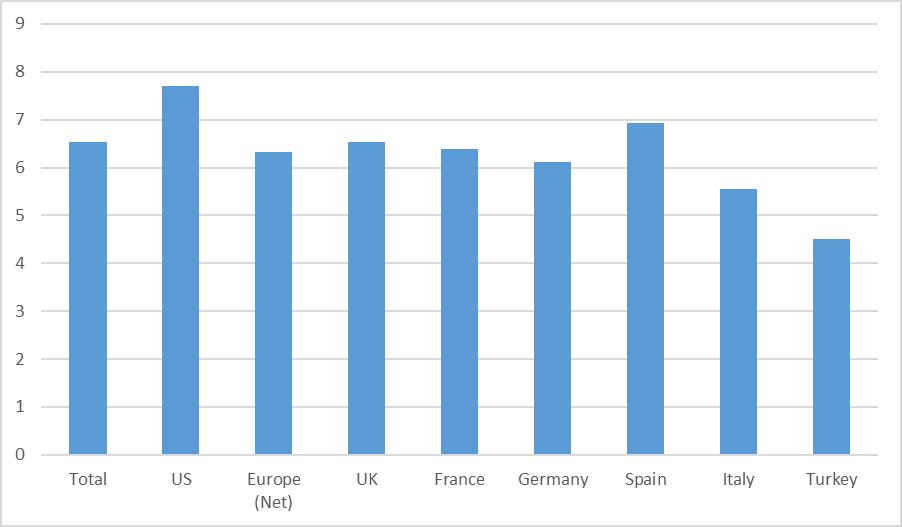

However, this figure is much higher than it should be. On average, factors such as management tools that don’t give the necessary control; a lack of transparency and unexpected bills that make it hard to predict spending; and inflexible pricing that doesn’t provide everything a business needs in a single package, means enterprises over-spend on cloud services by 29.23% (fig. 10), or $6.54 million a year (fig. 11).

Fig. 10 – Percentage added to cloud spend by specific factors

Fig. 11 – Average annual over-spend on cloud services ($USD millions)

Expectations and confidence

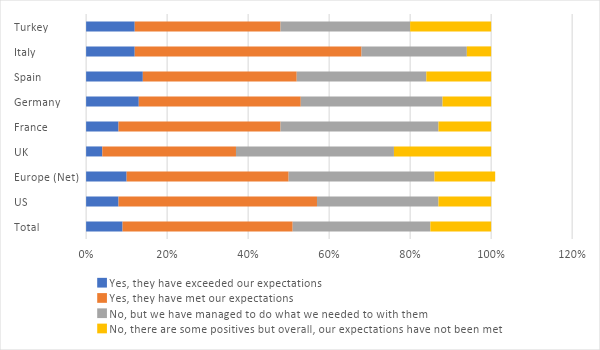

This overspend shows how flexible, transparently priced and cost-efficient technologies can give enterprises a viable path to the cloud without incurring additional costs. They can also help the cloud meet its end user’ expectations. 51% of respondents could confidently say that the cloud services they adopted in the last three years met their expectations (fig. 12): a figure that, while positive, could still be improved upon

Fig. 12 – Have cloud services met organizations’ expectations?

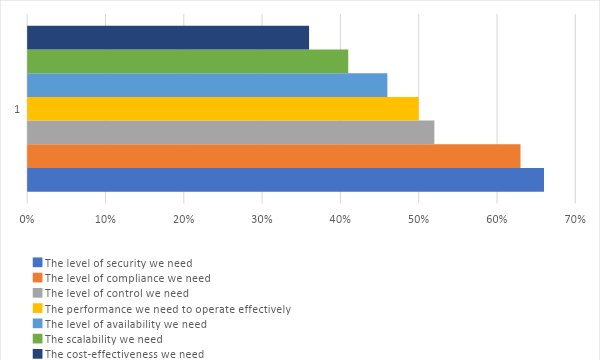

Enterprises also have varying levels of confidence in the services cloud providers supply. 66% of respondents were “completely confident” or “mostly confident” that their cloud services are providing the level of security they need, 41% in the level of scalability, and 36% in the level of cost-effectiveness they need (fig. 13). This is likely not only due to cloud service levels, but also businesses’ needs and expectations rising as they attempt to make the most out of every resource at their disposal.

Fig. 13 – Respondent confidence that service providers are providing…

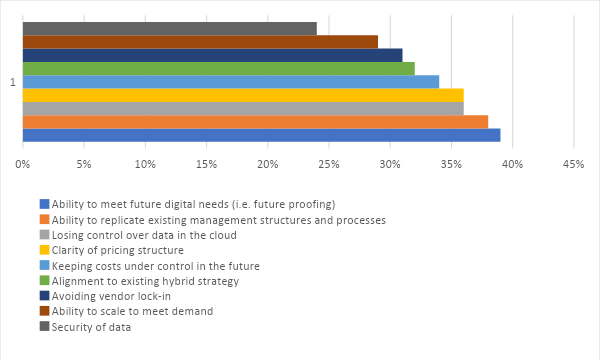

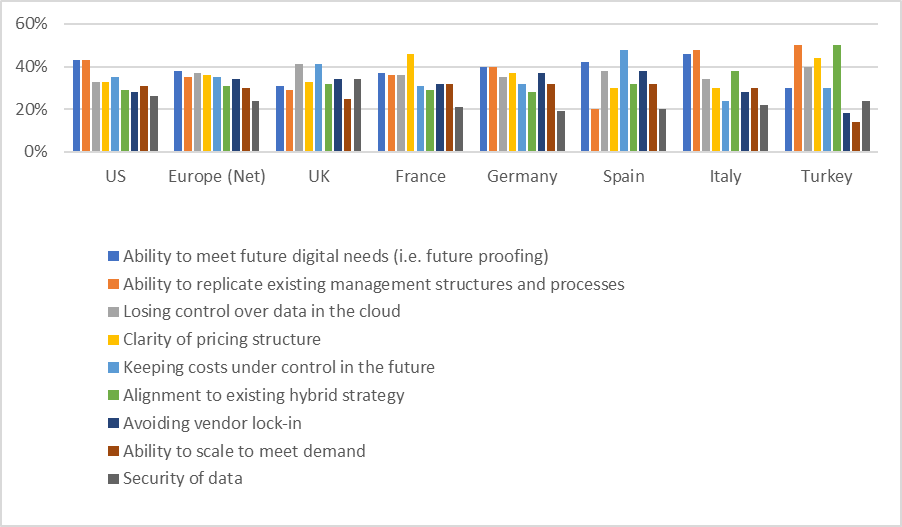

Organizations’ confidence in their cloud service providers is also reflected in the concerns they have when assessing new cloud infrastructure to support digital transformation. In 2022, by far the greatest concern was security. However, perhaps reflecting the fact that this is the area organizations have most confidence in, in 2023 it is the lowest concern – referenced by only 24% of respondents. Conversely, the ability to meet future digital needs, the ability to replicate existing management structures and processes, and losing control over data in the cloud were the most highlighted. Clearly management and control, along with cost, are where cloud providers will find themselves under most scrutiny from prospective customers. (fig. 14).

Fig. 14 – Greatest concerns when assessing new cloud infrastructure

Fig. 14a – Greatest concerns when assessing new cloud infrastructure (by region)

The future of IT

Despite individual concerns, it’s clear that enterprises are heavily invested in the cloud and see it as part of their future. In turn, the cloud is opening opportunities to transform the way in which IT operates within the business.

For instance, technologies such as low-code and no-code development, and consumption-based and serverless approaches to computing, make it easier than ever for individual business units to purchase and develop the services and applications they need to succeed. In this environment, IT’s role changes, becoming more consultative and helping other departments make the right technology decisions, while minimizing risk. This is especially important as enterprises look to take advantage of new technologies such as AI, and IT will need to spend its time understanding these new technologies, fitting them into business strategy, and showing their colleagues how to best use the technology without creating cost overruns or increasing risk.

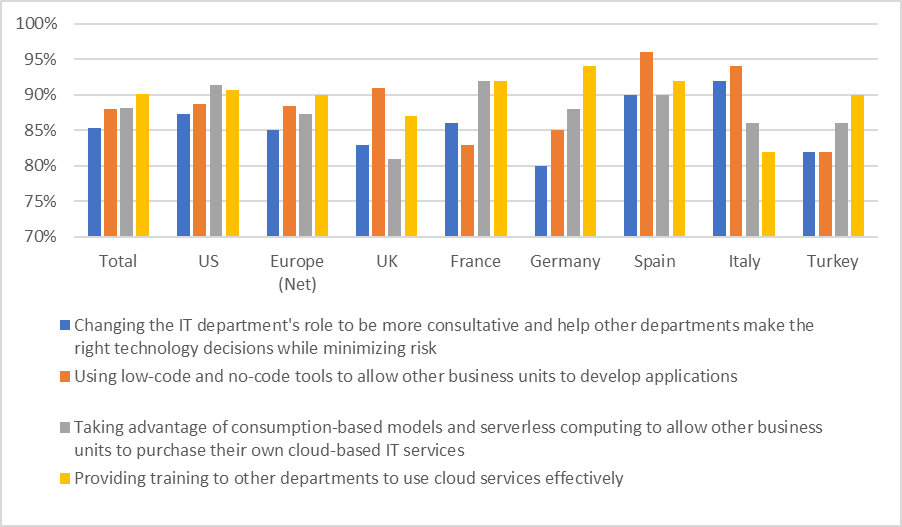

Most businesses have identified this opportunity and have either begun the process or plan to do so in the next 12 months. 85% are changing or have changed the IT department’s role to become more consultative, while 90% of functions are providing training to other departments to use cloud services effectively (fig. 15).

Fig. 15 – Organizations changing the role of IT

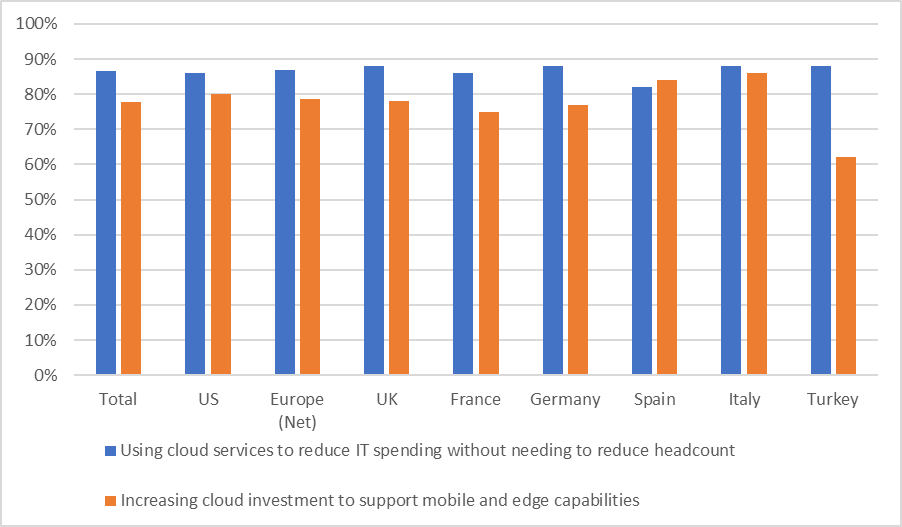

Enterprises are also focusing on the cloud to avoid spending cuts elsewhere, while still enabling greater use of new technologies. For instance, 87% are using cloud services to reduce IT spending without needing to reduce headcount, while 78% are increasing cloud investment to support mobile and edge capabilities (fig. 16).

Fig. 16 – Organizations using the cloud to support skills and technologies

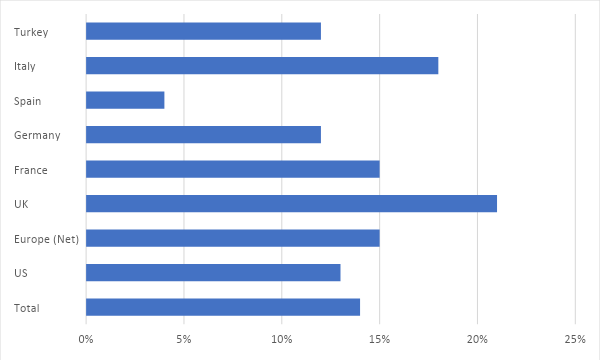

However much the role of the IT department is changing, it is definitely not becoming obsolete. Most enterprises recognize that business units cannot purchase and use IT themselves without IT’s guidance. At present, only 14% of organizations say that other departments are using the cloud to drive innovation and adopt new services without IT’s involvement. While this is reassuringly low, these organizations need to be certain that they understand the risks involved with this approach, and that IT has provided thorough training and advice (fig. 17).

Fig. 17 – Organizations where other departments use the cloud to drive innovation and adopt new services without IT’s involvement

The cloud is an essential part of the technology stack, especially as organizations move to take advantage of a new wave of AI-driven applications. Enterprises that can take advantage of secure, scalable cloud offerings, with flexible deployment options that allow them to meet their price-performance needs, will be much better suited to concentrate their energies on driving and evolving their business.

To learn more about Couchbase’s Capella fully-managed cloud database, visit https://www.couchbase.com/products/capella/start-today/