About Revolut

improvement over industry standards within one year of Couchbase

saved with Couchbase

of fraudulent transactions caught

Challenges

- Fraudsters are evolving to beat traditional predetermined fraud detection rules

- A mission-critical application required consistent high availability and high throughput for its rapidly growing customer base

- On average, financial fraud costs institutions between 7-8 cents out of every $100

Outcomes

- Sherlock’s high speed caching enabled machine learning algorithms to continually learn and update rules – catching 96% of fraudulent transactions

- Sherlock evaluates transactions for signs of fraud in under 50 milliseconds for Revolut’s 12+ million customers

- Within the first year in production with Couchbase, a 75% improvement over industry standards saved more than $3M

For our customers, the loss of $100 can mean the difference between a pleasant holiday and an experience filled with frustration and resentment. Couchbase has never failed us or our customers.

Dmitri Lihhatsov Financial Crime Product Owner, Revolut

Industry

Use case

- Fraud detection

- User profile store

- Digital communication

- Caching

Product

Key features

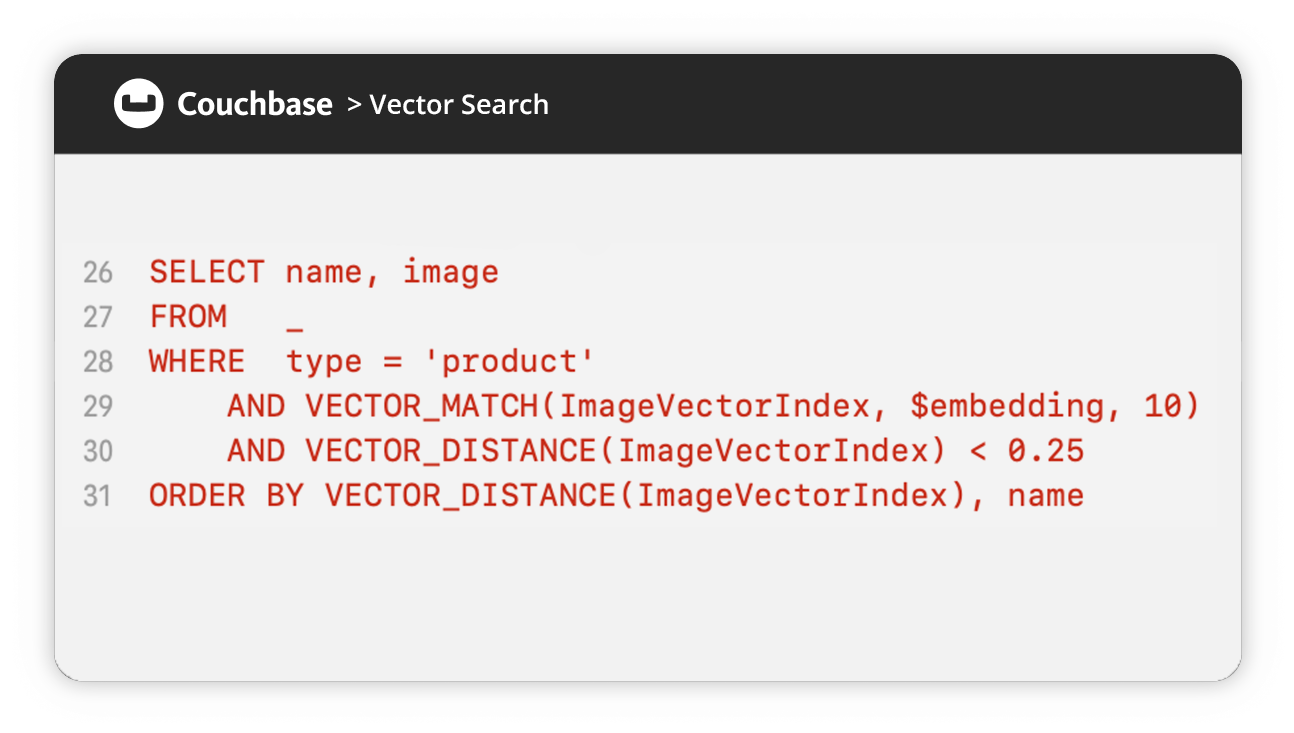

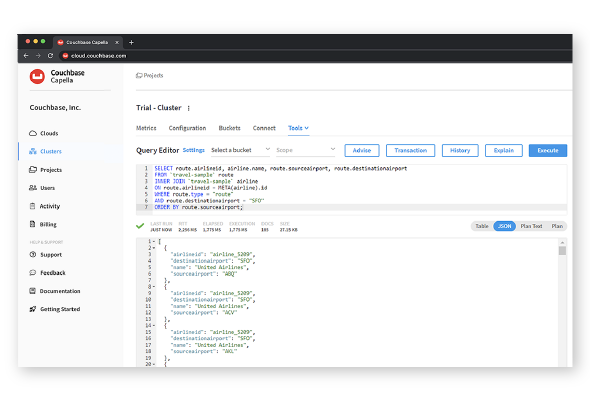

- SQL++

- Multi-dimensional scaling

- Cross datacenter replication

- In-memory database